Ember

Advanced Order Management

and Execution Platform

Backed by nearly 20 years in trading tech, Ember is our fastest, most advanced platform yet.

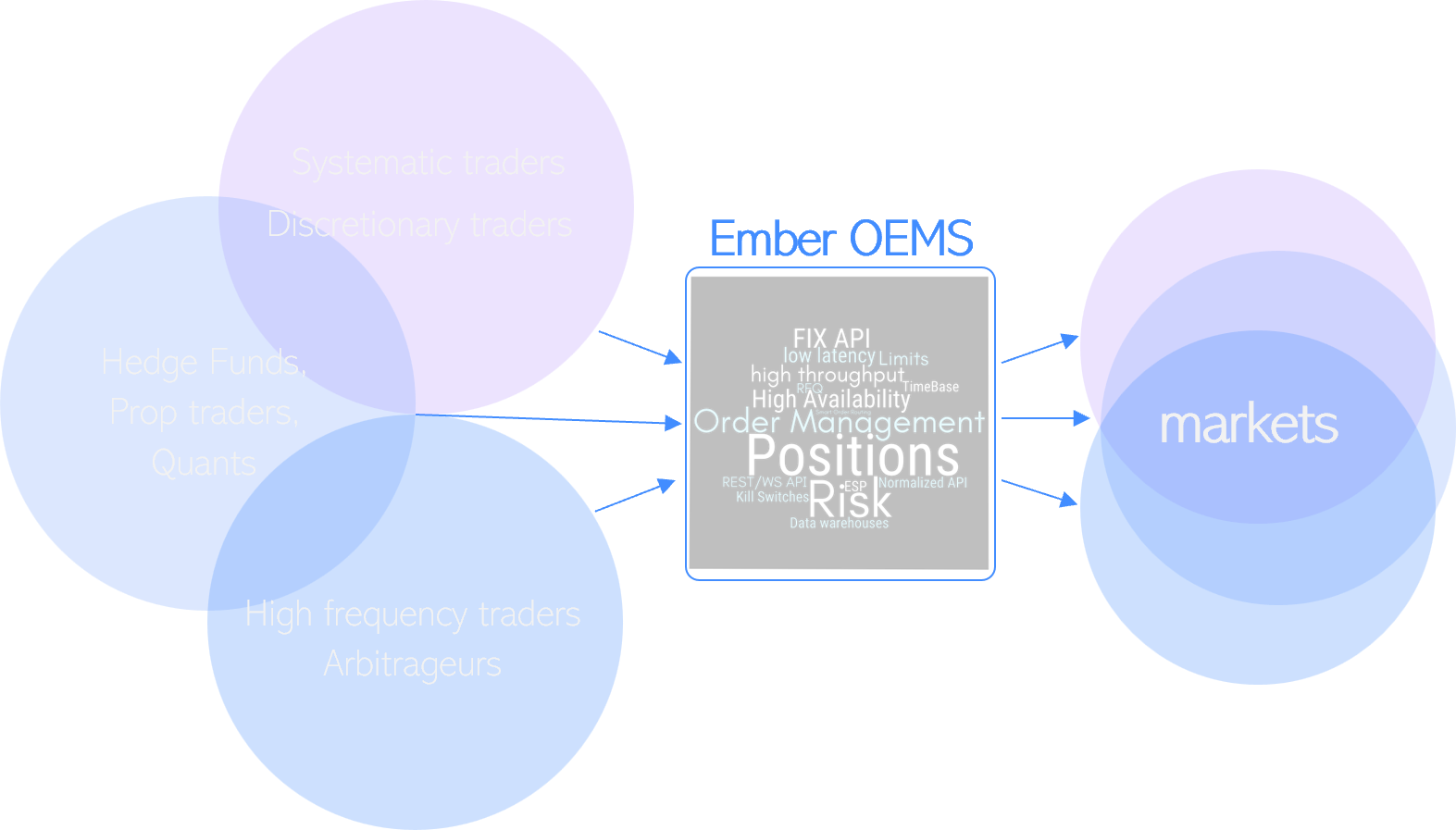

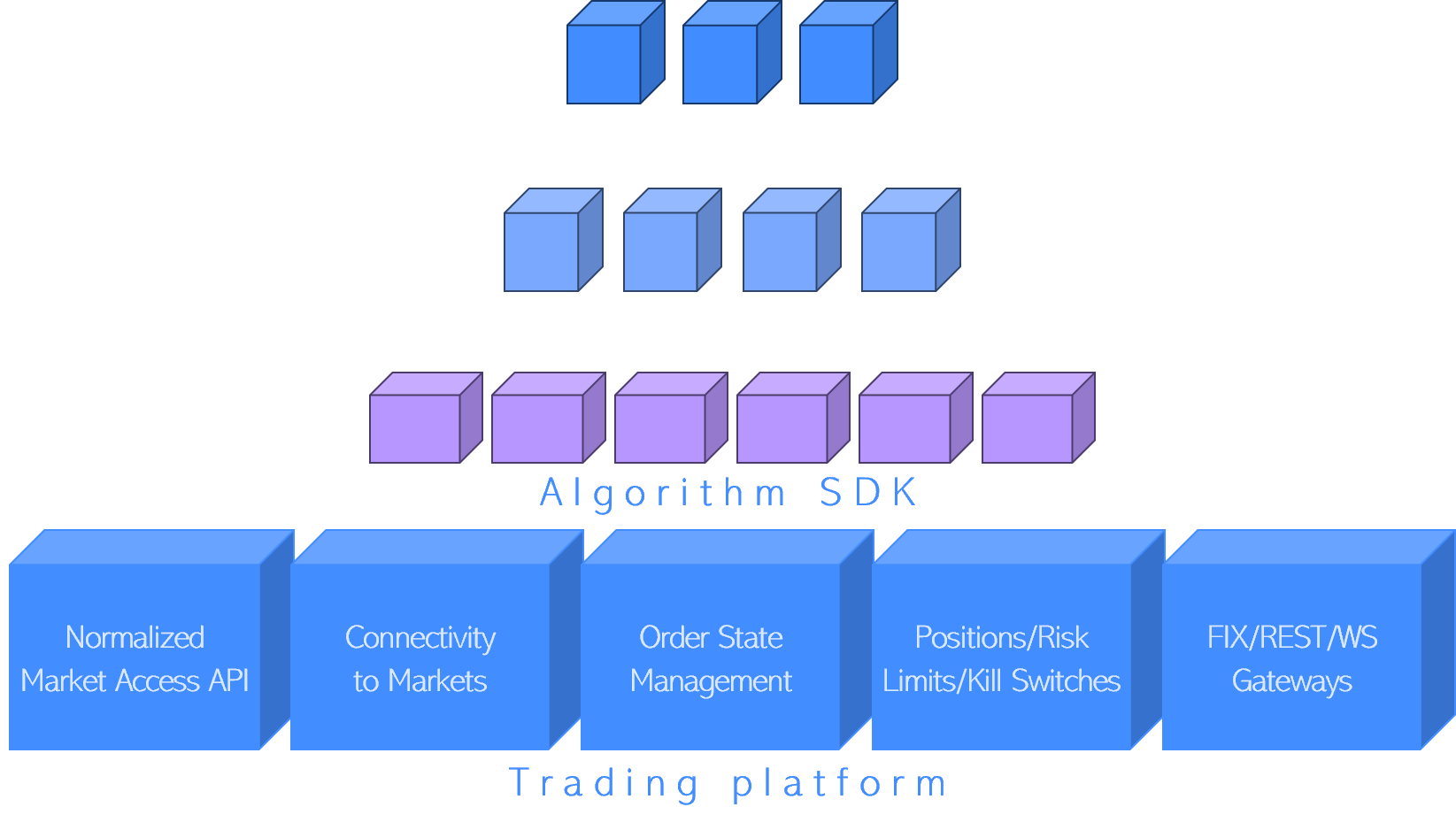

You can use Ember for

Ember integrated with the 150+ market venues:

Your venue not in the list? We have a dedicated team who specialize in market integrations

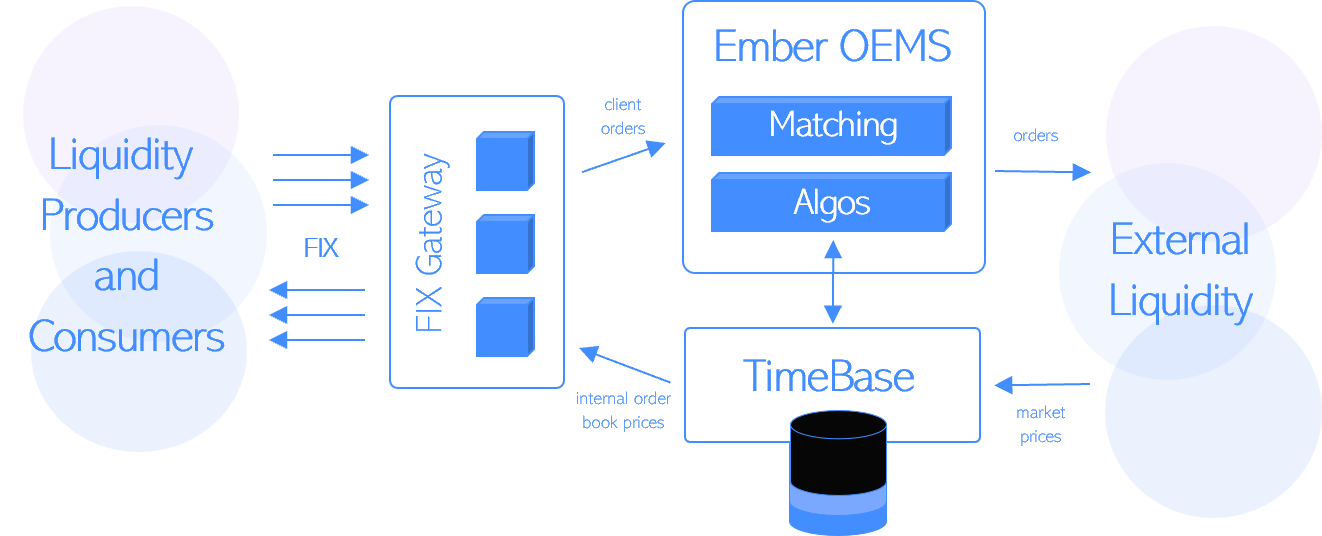

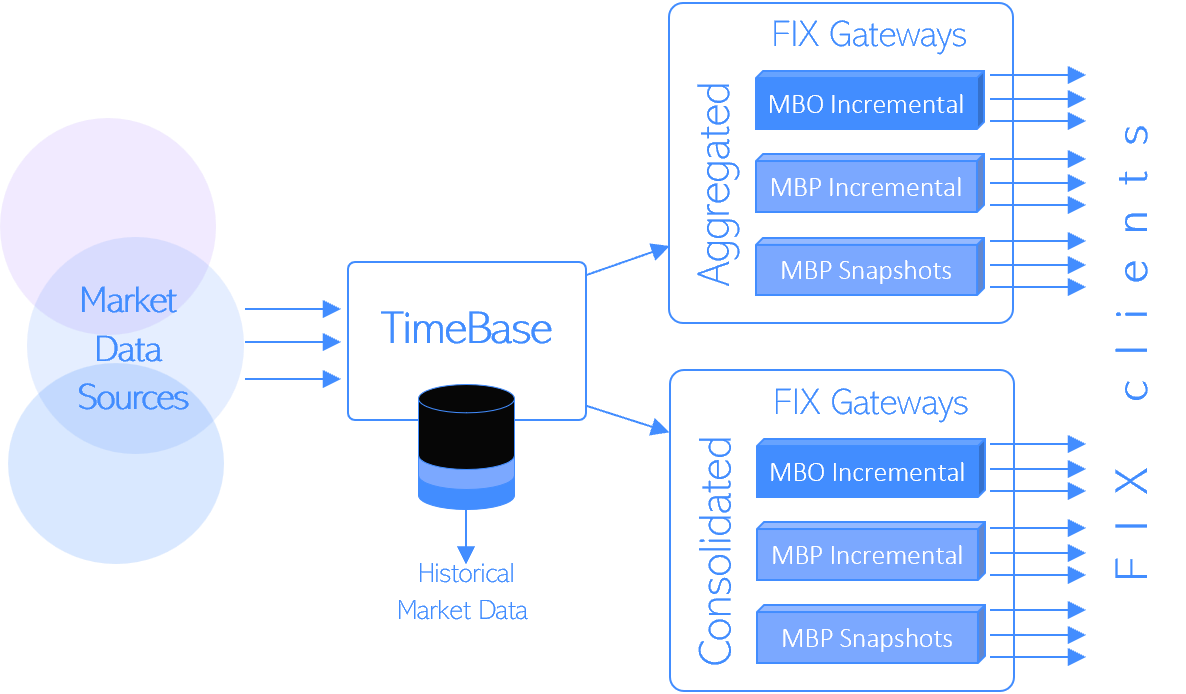

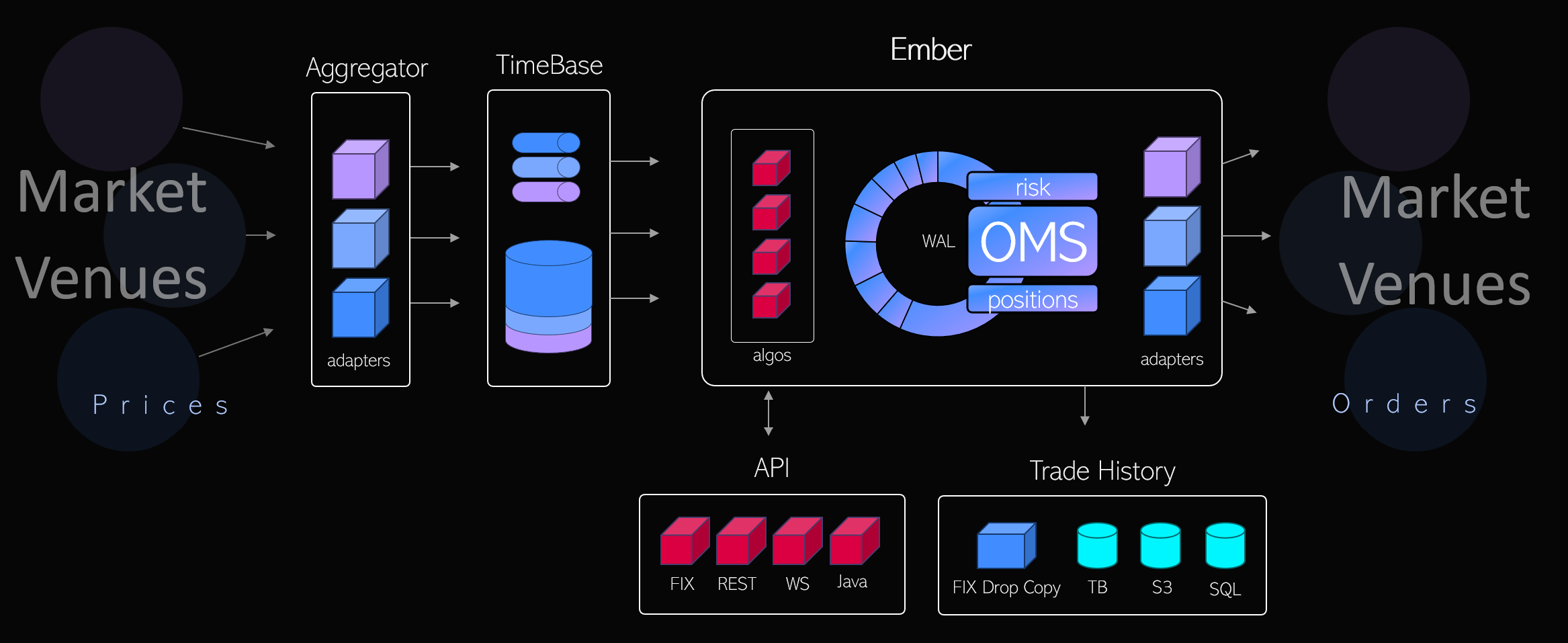

- Market Data Aggregator: A service that normalizes and aggregates market data from various sources, storing it in TimeBase.

- TimeBase: A time-series database developed by Deltix, used for market data aggregation, distribution, and custom complex event processing. For low-latency market data consumers (such as certain Ember algorithms), TimeBase offers IPC/Unicast topic channels that deliver nearly 100x the throughput and latency improvements over traditional data streams..

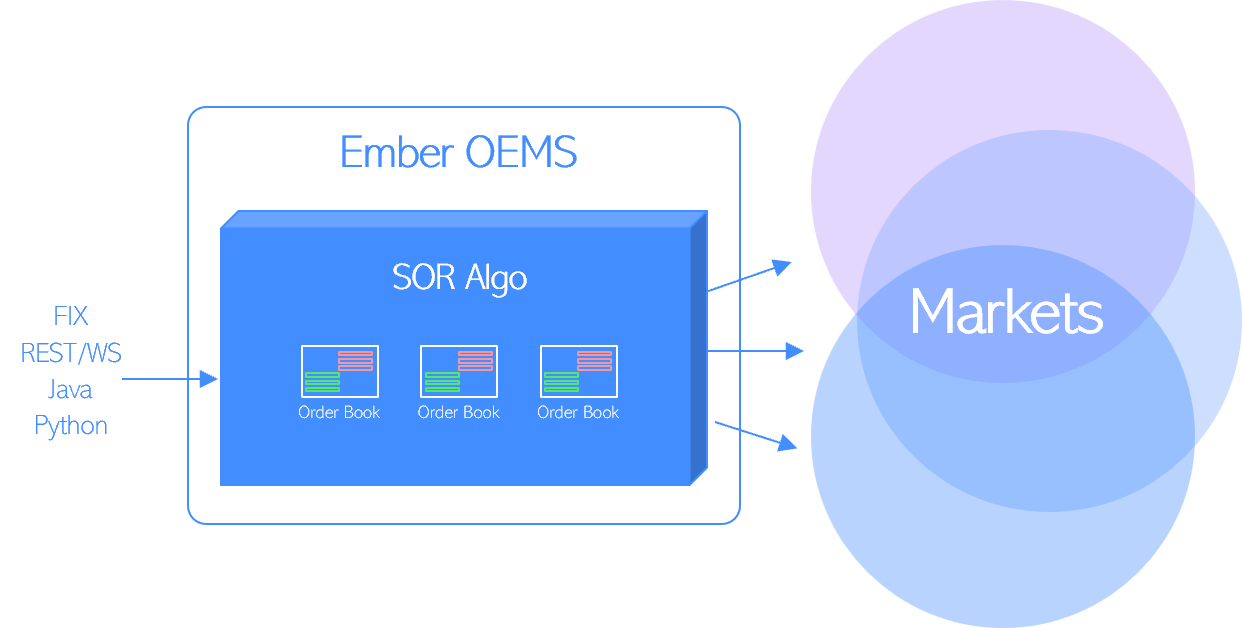

- Ember: The core service that manages Order and Position State, performs pre-trade risk checks, and runs algorithms with custom trading logic and adapters for each target trading venue. Ember uses an event-sourcing architecture and features a Write-Ahead Log (WAL or Ember Journal) to record trading requests and events impacting the OMS state. In high availability mode, the journal is synchronously replicated from the leader to the follower Ember instance. On-the-fly journal compaction and trading history warehousing support 24/7 system operation under heavy load.

- Trade History: Trading history can be streamed to various data warehouses for long-term storage and integration with back-office pipelines. This approach follows the CQRS design pattern, offloading intensive data queries from the OMS. Supported data warehouses include TimeBase, ClickHouse, Kafka, S3/Athena, Amazon Redshift, and RDS SQL Server. Ember also offers FIX Drop Copy services and distributes daily trading reports via mailing lists.

- APIs: Ember includes high performance FIX Gateways capable of servicing hundreds of Market data and Order Entry clients. REST and WebSocket gateway simplifies Python/JavaScript client integrations. Ember includes high-performance FIX gateways capable of serving hundreds of market data and order entry clients. The REST and WebSocket gateways facilitate Python and JavaScript client integrations. Ember also provides a Java RPC API that offers optimal performance for external order entry and enables remote control of Ember's internal operations.

-

Our address:

US Headquarters: 21 Drydock Avenue, Suite 410 W, Boston, MA 02210 -

Phone numbers:

Toll Free: +1 800 856 6120

Phone: +1 617 273 2540

Fax: +1 781 207 1296

-

E-mail:

Global Sales enquiries: sales@deltixlab.com

Media/Press enquiries: press@deltixlab.com

-

Press / media:

For media and press inquires, contact us at +1 800 856 6120 or press@deltixlab.com